The Greatest Guide To Transaction Advisory Services

Table of ContentsTransaction Advisory Services for BeginnersTransaction Advisory Services - The FactsTransaction Advisory Services Can Be Fun For AnyoneOur Transaction Advisory Services StatementsWhat Does Transaction Advisory Services Mean?

This action makes certain the business looks its best to possible customers. Getting the organization's value right is crucial for a successful sale.Deal consultants step in to assist by obtaining all the required info organized, addressing concerns from purchasers, and arranging visits to the business's location. Deal experts use their knowledge to aid organization proprietors take care of hard negotiations, meet buyer assumptions, and framework offers that match the owner's objectives.

Satisfying legal policies is important in any type of organization sale. They aid service proprietors in intending for their following actions, whether it's retirement, beginning a new venture, or managing their newfound wealth.

Purchase experts bring a riches of experience and understanding, making certain that every aspect of the sale is handled properly. Via strategic preparation, appraisal, and arrangement, TAS aids entrepreneur achieve the greatest feasible price. By guaranteeing lawful and regulative compliance and handling due diligence alongside various other deal employee, deal advisors decrease possible risks and obligations.

8 Easy Facts About Transaction Advisory Services Described

By comparison, Large 4 TS groups: Deal with (e.g., when a potential customer is carrying out due persistance, or when a bargain is closing and the purchaser requires to integrate the company and re-value the vendor's Annual report). Are with fees that are not linked to the offer closing efficiently. Earn fees per engagement someplace in the, which is much less than what financial investment banks earn even on "tiny bargains" (however the collection likelihood is also much higher).

, but they'll focus a lot more on bookkeeping and evaluation and much less on subjects like LBO modeling., and "accounting professional just" subjects like test balances and just how to stroll through occasions using debits and credit histories rather than monetary statement changes.

What Does Transaction Advisory Services Mean?

that demonstrate just how both metrics have altered based on products, networks, and customers. to evaluate the accuracy of management's past forecasts., consisting of aging, supply by product, average degrees, and provisions. to determine whether they're entirely imaginary or somewhat believable. Professionals in the TS/ FDD teams might also talk to administration regarding whatever over, and they'll write a thorough record with their searchings for at the end of the procedure.

, and the basic form looks like this: The entry-level role, where you do a lot of data and monetary evaluation (2 years for a promotion from right here). The next level up; comparable job, however you obtain the even more intriguing little bits (3 years for a promo).

Particularly, it's hard to obtain advertised beyond the Manager degree since few people leave the job at that stage, and you need to start revealing evidence of your ability to generate profits to advancement. Allow's begin with the hours and way of life considering that those are much easier to describe:. There are periodic late evenings and weekend job, however over here nothing like the frantic nature of investment banking.

There are cost-of-living modifications, so expect reduced payment if you're in a cheaper area outside major monetary (Transaction Advisory Services). For all positions other than Companion, the base salary makes up the mass of the complete payment; the year-end reward could be a max of 30% of your base salary. Typically, the finest method to increase your profits is to change to a different company and negotiate for a higher income and incentive

The Of Transaction Advisory Services

You can enter into company growth, however investment financial obtains more hard at this stage due to the fact that you'll be over-qualified for Analyst duties. Corporate financing is still an alternative. At this phase, you ought to simply stay and make a run for a Partner-level role. If you wish to leave, maybe transfer to a customer and perform their valuations and due diligence in-house.

The major trouble is that since: You normally need to sign up with one more Huge 4 team, such as audit, and job there for a couple of years and then move into TS, job there for a couple of years and after that relocate into IB. And there's still no assurance of winning this IB role since it depends on your region, clients, and the employing market at the time.

Longer-term, there is additionally some danger of and due to the fact that assessing a company's historic economic information is not specifically rocket scientific research. Yes, people will always need to be involved, however with even more innovative innovation, lower head counts might possibly sustain client engagements. That claimed, the Transaction Services team defeats audit in terms of pay, work, and leave opportunities.

If you liked this article, you could be curious about reading.

Getting The Transaction Advisory Services To Work

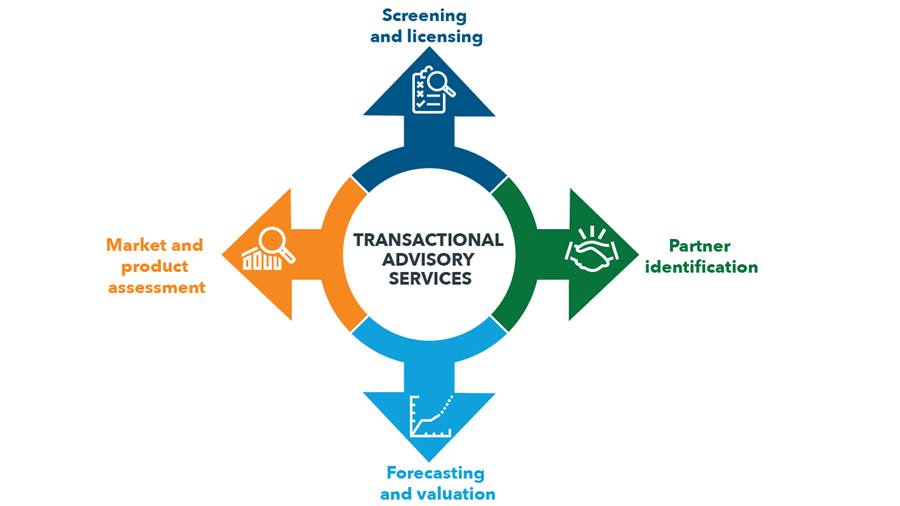

Create innovative economic structures that help in determining the real market value of a company. Supply consultatory operate in relation to service valuation to aid in bargaining and pricing frameworks. Describe one of the most appropriate kind of the bargain and the type of factor to consider to use (cash money, supply, earn out, and others).

Develop action plans for risk and exposure that have been identified. Do combination planning to establish the procedure, system, and organizational changes that may get more be needed after the bargain. Make mathematical estimates of assimilation prices and advantages to assess the financial rationale of integration. Establish guidelines for incorporating divisions, innovations, and service processes.

Assess the possible consumer base, sector verticals, and sales cycle. The functional due persistance uses essential understandings right into the functioning of the company to be obtained concerning danger evaluation and value production.